20 Survival Tips for Homeowners Being a homeowner can be exciting and fun at times, with lots of freedom to make it your own space! As a homeowner, though, you’re the one in charge of any repairs, maintenance, finances, and improvements over the long haul. Whether you’re a first time homeowner or you’ve owned many, […]

continue reading...

3 Errores Comunes Que Reducen Los Puntajes De Crédito Ya sea que lo sepa o no, es posible que haya cosas que esté haciendo que puedan afectar negativamente su puntaje crediticio. Incluso si no va a comprar una casa en el corto plazo, no quiere que su puntaje crediticio lo sorprenda cuando quiera comprar un […]

continue reading...

3 Common Mistakes that Lower Credit Scores Whether you know it or not, there might be things you are doing that can effect your credit score for the worse. Even if you aren’t buying a home anytime soon, you don’t want to be surprised by your credit score when you want to buy a car […]

continue reading...

Preguntas y Respuestas: Las 3 Preguntas Más Formuladas Por Clientes Anteriores Yo se que mi trabajo no termina en la mesa de cierre, y quiero ser su recurso para todo lo relacionado con bienes raíces, incluso después de mudarse a su primera casa. A continuación se encuentran las preguntas más frecuentes de los clientes anteriores […]

continue reading...

Q and A: The 3 Questions Most Asked by Past Clients I believe my job doesn’t end at the closing table, and I want to be your resource for all things real estate related even after you move into your first home. Below are the questions asked most by past clients who have bought a […]

continue reading...

¿Cuándo DEBE Pagar Su Hipoteca? La semana pasada discutimos porqué pagar su hipoteca podría no ser la opción correcta para muchos dueños de viviendas, ya que podría usar cualquier dinero extra en inversiones de mayor rendimiento o mantener un acceso más fácil a estos fondos que estar inmovilizado en su casa. Sin embargo, hay algunas […]

continue reading...

When SHOULD You Pay Down Your Mortgage? In the previous article, we discussed why paying down your mortgage might not be the right choice for many homeowners since you could use any extra cash in higher return investments or maintain easier access to these funds than being tied up in your home. However, there are […]

continue reading...

¡No Pague Su Hipoteca! A primera vista, puede parecer lógico tomar cualquier dinero extra que pueda tener (¡gracias bono de trabajo!) y pagar su hipoteca. Parece una buena idea en la superficie, pero profundicemos más y veamos si es adecuado para USTED. Abordar la deuda hipotecaria por la vía rápida no es muy recomendable a […]

continue reading...

Don’t Pay Down Your Mortgage! At first thought, it may seem logical to take any extra money you might have (thank you work bonus!) and pay down your mortgage. Seems like a good idea on the surface, but let’s dive deeper and see if it’s right for YOU. Tackling mortgage debt on the fast track […]

continue reading...

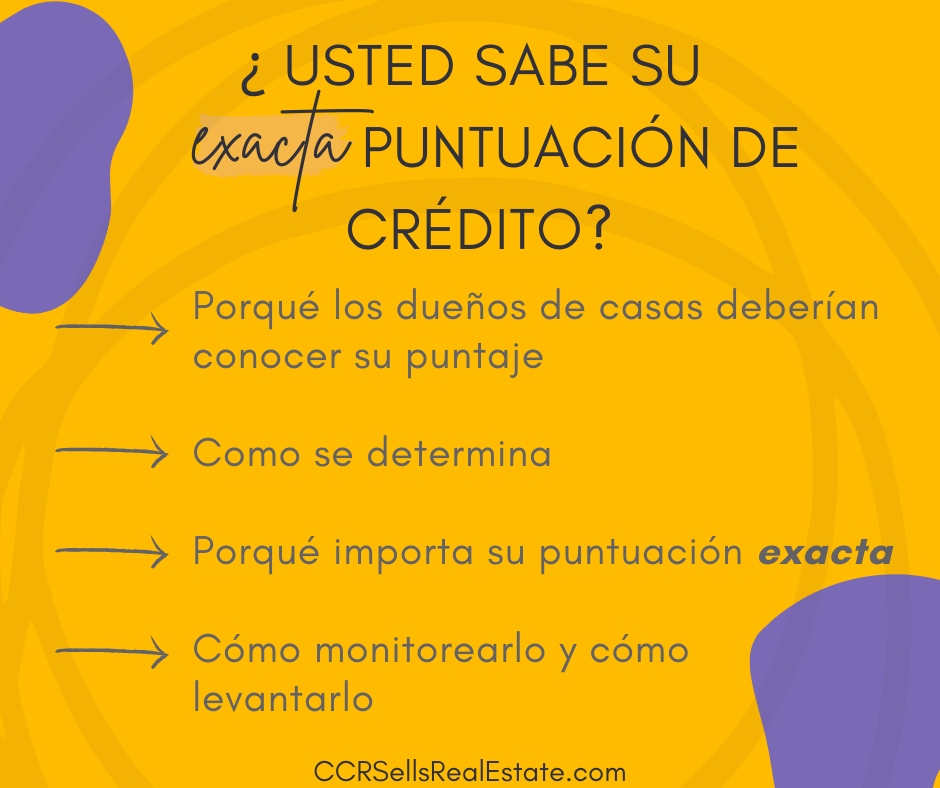

Porqué Debe Conocer Su Puntaje Crediticio Exacto ¿Le está dando a su puntaje de crédito la atención que merece? Si incluso está pensando en comprar una casa o refinanciar la que tiene, ahora o en un futuro cercano, entonces necesita mostrarle algo de attencíon. Asegúrese de comprender los entresijos de su puntaje y lo que […]

continue reading...

Hi, I’m Carmen Cotto-Rivera and I love helping first time homebuyers in Burlington County (and surrounding areas) in South Jersey and PA, find an affordable place to live. It is possible, let me show you how!

When I bought my last home completely by myself, it was a very stressful yet exhilarating experience. I needed someone to help me and explain each and every step of the process. After closing, I was so stressed that I went to my old apartment and fell asleep!

My real estate agent was competent with the basics, but I had to do a lot of the legwork myself and was not made aware of some first time homebuyer programs that were available until after I bought my home.

Through this whole experience, I fell in love with the process, and it made me decide to become the type of real estate agent that is with their buyers every step of the way! Schedule a free consultation now!